INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND SERVICES

During Fiscal 2020, EY served as• Michael A. Mathias, our independent registered public accounting firm and, in that capacity, rendered an unqualified opinion on our consolidated financial statements as of and for the year ended January 30, 2021.Executive Vice President, Chief Financial Officer (the “CFO”);

The following table sets forth the aggregate fees billed to us by our independent registered public accounting firm in each of the last two fiscal years:

| | | | | | | | | Description of Fees | | Fiscal 2020 | | | Fiscal 2019 | | Audit Fees | | $ | 2,250,375 | | | $ | 1,881,500 | | Audit-Related Fees | | | 28,000 | | | | 26,250 | | Tax Fees | | | 476,667 | | | | 467,434 | | All Other Fees | | | 5,200 | | | | 4,000 | | Total Fees | | $ | 2,760,242 | | | $ | 2,379,184 | |

“Audit Fees” include fees billed for professional services rendered in connection with (1) the audit of our consolidated financial statements, including the audit of our internal control over financial reporting, and the review of our interim consolidated financial statements included in quarterly reports; (2) statutory audits of foreign subsidiaries; and (3) services that generally only the independent registered public accounting firm can reasonably be expected to provide, including comfort letters, consents, assistance with the review of registration statements filed with the SEC and consultation regarding financial accounting and/or reporting standards. “Audit-Related Fees” include fees billed for audits of the Company’s employee benefit plan. “Tax Fees” primarily include fees billed related to federal, state, and local tax compliance and consulting. “All Other Fees” include fees billed for accounting research software.

The Audit Committee has adopted a policy that requires pre-approval of all audit services and permitted non-audit services to be performed by the independent registered public accounting firm, subject to the de minimis exceptions for non-audit services as described in Section 10A(i)(1)(B) of the Exchange Act that are approved by the Audit Committee prior to the completion of the audit. The Audit Committee may form and delegate the authority to grant pre-approvals of audit and permitted non-audit services to subcommittees consisting of one or more members when it deems appropriate, provided that decisions of such subcommittee shall be presented to the full Audit Committee at its next scheduled meeting. All audit and non-audit services provided to the Company by EY during Fiscal 2020 were pre-approved by the Audit Committee in accordance with such policy.

| | | | | 46 | | |

| |

|

| | • Jennifer M. Foyle, our President, Executive Creative Director, AE and Aerie (the “President”); | | • Michael R. Rempell, our Executive Vice President, Chief Operations Officer (the “COO”); | | • Marisa A. Baldwin, our Executive Vice President, Chief Human Resources Officer (the “CHRO”); and | | • Andrew J. McLean, our former Executive Vice President, Chief Commercial Officer (the “Former CCO”) who left the Company effective September 12, 2022. |

This CD&A is organized as follows:

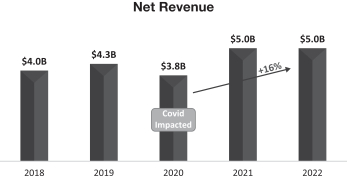

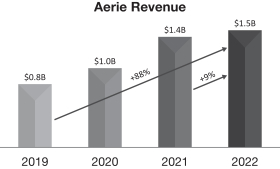

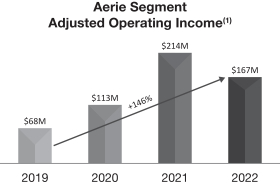

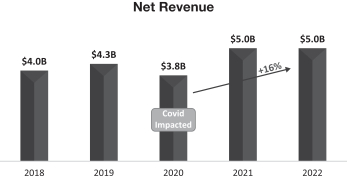

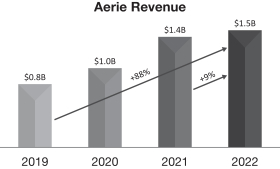

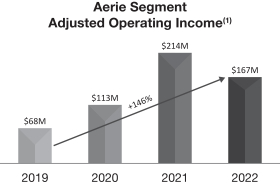

Business Highlights Fiscal 2022: Overview Fiscal 2022 was defined, for our industry and our business, by a difficult macro environment. As we lapped outstanding results from the prior year, we grappled with rising inflation, higher interest rates, continued supply chain disruptions and a highly promotional retail landscape, each of which created challenges. Against this backdrop, financial results reflected a tale of two halves. While profitability and cash flow were pressured in the first half of Fiscal 2022, swift and aggressive actions to reduce inventory levels and cut expenses and capital spending drove a rebound in the second half. As a result, adjusted operating income(1) of $213 million in the second half of Fiscal 2022 represented meaningful improvement compared to $56 million in the first six months of the year. We also returned to a positive free cash flow position and strengthened our balance sheet. As we navigated these headwinds, we continued to make progress against our long-term strategic initiatives. Full-year consolidated revenue of $5 billion was our second highest in company history and included our second highest Back-to-School and Holiday sales ever. This was down only to last year’s record result, which had benefited from a very strong demand environment. Operating income during the last six months of Fiscal 2022 was up as compared to the same period in pre-pandemic Fiscal 2019, reflecting the benefits of the strategic initiatives we are pursuing as part of our long-term “Real Power. Real Growth.” value creation plan. Aerie’s incredible brand platform continued to see exceptional multi-year growth with record revenue of $1.5 billion, approximately double that of Fiscal 2019 and segment adjusted operating income(1) up close to 150% over | (1) | PROPOSAL THREE: ADVISORY APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

As required by Section 14ASee Appendix A of the Exchange Act, we are providing stockholders with an advisory vote on the overall compensation of our named executive officers. In accordance with the results of the stockholder vote at the 2017 Annual Meeting, advisory votes on the overall compensation of our named executive officers are held every year, and there will be another vote on the frequency of the say on pay vote at the 2023 Annual Meeting.

As discussed in the “Compensation Discussion and Analysis” section below, our executive compensation program is based on four core principles: performance, competitiveness, affordability, and transparency. We believe that our program design implements these principles and provides the framework for alignment between executive compensation opportunities and long-term strategic growth. Based on the advisory vote at the 2020 Annual Meeting on our executive compensation program, which was approved by approximately 98% of the votes cast, we are confident that our stockholders agree.

We have an ongoing commitment to ensuring that our executive compensation plans are aligned with our principles and evolve as the industry and business changes. During Fiscal 2020 our Compensation Committee reacted to unprecedented challenges by evolving our compensation program to ensure it continued to motivate, retain and reward our executives and associates while enabling our strategic growth plans. We continued to engage with our stockholders to gain an understanding of their key perspectives on all aspects of the business and the broader industry, including compensation programs. We continued to evaluate and enhance plan design to align with leading practices in executive compensation, and we believe our plan in 2020 helped lead to the strong results and stockholder returns we delivered.

We urge our stockholders to read the following “Compensation Discussion and Analysis” section for information on our executive compensation program.

In summary, we believe that our executive compensation program has provided and continues to provide appropriate incentives and remains responsive to our stockholders’ views. Accordingly, the following resolution will be submitted for a stockholder vote at the 2020 Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, as set forth in thethis Proxy Statement for the 2021 Annual Meeting.”

As an advisory vote, your vote will not be bindingadditional detail on the Company or the Board. However, our Board and our Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the compensation paid to our named executive officers (“NEOs”), we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

The Board recommends that the stockholders vote “FOR” the

approval of the compensation of our named executive officers as set forth in this

Proxy Statement for the Annual Meeting.

| | | | | 2021 Proxy Statement

| | |

| | 47 |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) describes our compensation philosophy, objectives, policies, and practices with respect to our NEOs for Fiscal 2020. The following officers comprise our Fiscal 2020 NEOs:

| | • Jay L. Schottenstein, our Chief Executive Officer (the “CEO”);

| | • Michael A. Mathias, our Executive Vice President, Chief Financial Officer (the “CFO”), effective April 20, 2020;

| | • Jennifer M. Foyle, our Chief Creative Officer, AEO Inc. & Global Brand President, Aerie (the “Chief Creative Officer”);

| | • Charles F. Kessler, our Global Brand President, American Eagle (the “Global Brand President, AE”);

| | • Michael R. Rempell, our Executive Vice President, Chief Operations Officer (the “COO”); and

| | • Robert L. Madore, our former Executive Vice President, Chief Financial Officer (the “Former CFO”) who left the EVP-CFO role effective April 20, 2020 and left the Company effective September 25, 2020.

|

This CD&A is organized as follows:

| | | | | 48 | | |

| |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

EXECUTIVE SUMMARY

Navigating the Challenges of COVID-19

The past year was filled with unprecedented challenges, yet ultimately led us to learn, grow, and become even stronger as a Company. Our business in Fiscal 2020 was significantly impacted by the disruptions caused by the COVID-19 pandemic, including the mandated closure of our stores in March 2020, followed by continued capacity restrictions and pressure on mall traffic throughout the year. In response to the global health crisis, we took quick, decisive actions to (1) protect our associates, customers and communities; (2) reduce spending, cut inventory and create efficiencies to preserve financial strength; and (3) innovate to prepare for a new future of retail. This strategy, which we termed our “Pandemic Pillars,” deliveredadjusted results in Fiscal 2020 and, we believe, has positioned us for future growth.

Our response to the COVID-19 pandemic was immediate and deliberate. On March 17, 2020, we closed all American Eagle and Aerie stores in the United States and Canada. While store closures helped keep our communities and associates safe, they also led to the very difficult decision of temporarily furloughing store, field, and some corporate associates beginning April 5, 2020. During this time, in recognition of the hardships imposed on our associates as a result of store closures and other impactsimportant information regarding the use of the pandemic to our associates, customers, and communities, we continued to put our people first and implemented the following actions:

We maintained benefits for furloughed associates and continued to fund 100% of the health premiums for eligible employees impacted by these measures.

We instituted industry-leading safety protocols across our operations, including the procurement of masks and PPE for all teams, the hiring of an AEO medical consultant, physical construction to enable social distancing mandates, temperature check stations, installing infrared lighting and air filtration systems in the distribution centers, new breakroom and cafeteria protocols, creating training and videos to explain new safety measures and expectations, and on-site nurses.

After temporary store closures in the spring, we drafted and deployed a comprehensive global store re-opening playbook (ensuring customer safety; managing capacity restrictions and reduced operating hours; and implementing curbside pickup and touchless checkout).

We created the COVID-19 Associate Relief Fund to provide grants to eligible AEO associates who were adversely impacted by COVID-19; distributed AEO Foundation grants to non-profits in local communities; and donated over $1 million nationally to COVID-19 relief efforts, including donating gift cards and more than one million masks to front-line workers in cities most in need.

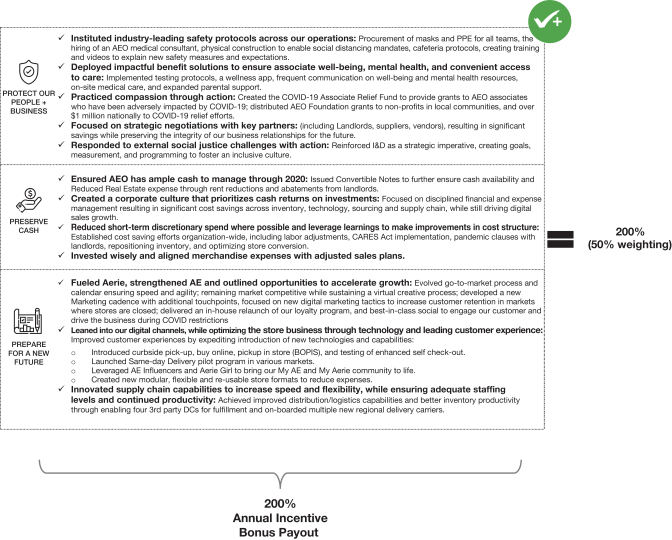

Despite the profound challenges of operating during a global pandemic and the impact of COVID-19 to apparel retailers – with three companies in our peer group filing for bankruptcy during the year – we ended Fiscal 2020 with performance that significantly outperformed peers. Our success in 2020 was driven by the commitment and innovation of our most important asset – our people. We are grateful for their dedication to our Company, our customers and each other in an incredibly challenging year. As a result of this extraordinary performance, all eligible associates received an annual incentive bonus for Fiscal 2020 representing 200% of the target bonus amount.

2020 Performance Highlights

After a difficult start with the abrupt closure of all stores during the first quarter of Fiscal 2020, we ended fiscal 2020 with a strong fourth quarter and momentum going into 2021, as evidenced by the following:

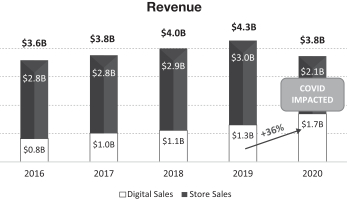

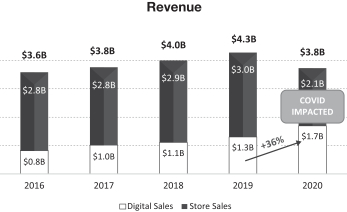

Our online business accelerated throughout the year, rising 36% on a year-over-year basis to $1.7 billion, with revenue up across all of our brands fueled by strong customer demand.

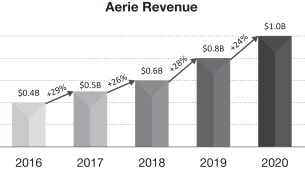

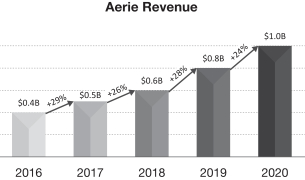

Aerie reached a record $1 billion milestone and continued to generate double-digit growth – a truly extraordinary accomplishment in light of the pandemic.

We successfully operated our stores with leading health and safety measures, and our business strengthened each quarter throughout Fiscal 2020.

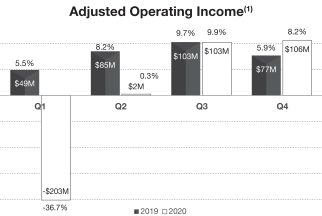

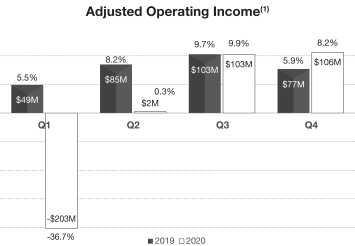

• | | In the fourth quarter of Fiscal 2020, we achieved a meaningful recovery, posting $106 million in adjusted operating income(1), a 38% increase from 2019, with margins increasing across brands. We ended the year in strong financial condition, with $850 million in cash and approximately $1.2 billion in total liquidity.

|

(1) | See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures.

|

| | | | | | | | | | | | 50 | | | | |  | | | | | | | 2021 Proxy Statement

|

| | | | | COMPENSATION DISCUSSION AND ANALYSIS |

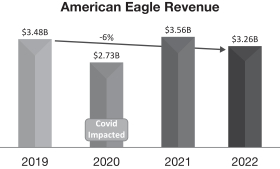

Fiscal 2019. American Eagle (“AE”) achieved operating income and margin expansion compared to Fiscal 2019, driven by structural changes we have enacted to improve brand health. We strengthened our balance sheet, retiring $403 million of outstanding convertible debt and returned $265 million in cash to stockholders through a combination of share repurchases and dividends, our highest level of returns since Fiscal 2015. Key Operating Highlights: Second Highest Revenue Result in Company History. During Fiscal 2022, consolidated revenue of $5 billion was roughly flat to the prior year, including an approximately three percentage point benefit from Quiet Platforms. Brand revenue declined 3% as we lapped extraordinary strength in Fiscal 2021 that had been fueled by stimulus and pent-up demand, yet was up 13% compared to the pre-pandemic Fiscal 2019 base, marking our second highest revenue result in Company history. Brand and channel performance reflected tough year over year comparisons and the prevailing macro environment. Aerie revenue grew 9% compared to Fiscal 2021. The digital channel represented 35% of brand revenue for the year, compared to 29% in Fiscal 2019.

Meaningful Operating Income and Margin Recovery in the Second Half of Fiscal 2022. During Fiscal 2022, we delivered $269 million in adjusted operating income(1) reflecting an operating margin of 5.4%. While profitability was challenged in the first half of the year, swift and aggressive actions to reduce both inventory levels and expenses drove a rebound in the second half of the year. Adjusted operating income of $213 million in the second half of Fiscal 2022 represented a 7.8% adjusted operating margin(1) and was meaningfully improved compared to $56 million in operating income and a 2.5% operating margin in the first half. Second half profitability also grew 19% relative to the pre-pandemic second half of Fiscal 2019 operating income with the operating margin expanding 20 basis points. Multi-Year Aerie Brand Growth. During Fiscal 2022, Aerie revenue rose 9% to $1.5 billion, on top of 39% growth in Fiscal 2021. Growth was led by OFFLINE, Aerie’s activewear sub-brand launched in Fiscal 2020, as we continued to expand the assortment into new categories across performance and fashion styles. New store expansion continued to build greater awareness and Aerie reached a new milestone of 10 million customers. Segment adjusted operating income (1) of $167 million was down as compared to the prior year driven by higher markdowns as the brand anniversaried a low promotional environment in Fiscal 2021 and took higher markdowns to clear through excess inventory in the second quarter of Fiscal 2022. When comparing to pre-pandemic Fiscal 2019 levels, revenue nearly doubled and operating income was up almost 150%.

| COMPENSATION DISCUSSION AND ANALYSIS |  | |  |

| (1) | Key Operating Highlights:

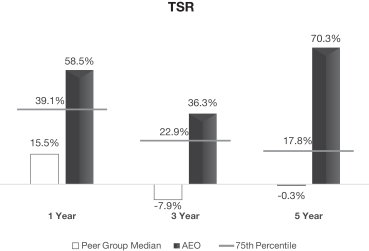

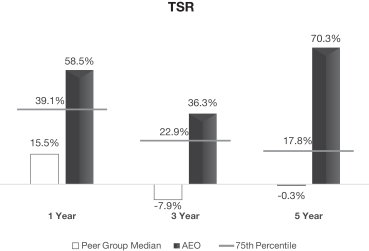

TSR That Significantly Outperformed Peers. BasedSee Appendix A of this Proxy Statement for additional detail on our competitive strengthsadjusted results and exciting growth opportunities for our brands, Aerie and American Eagle, we were pleased to see AEO’s total stockholder return (“TSR”) exceed thoseother important information regarding the use of our retail peers. Our Fiscal 2020 TSR was approximately 59%, significantly above our peer group median of 15%. Our three-year TSR of 36% and five-year TSR of 70% were each significantly above the peer group medians, which were negative 8% and 0%, respectively.

Digital Sales Accelerated. During Fiscal 2020, online revenues grew by $450 million, or 36% year-over-year, to $1.7 billion and represented 45% of our total revenue. Driven by strong customer demand, we saw digital growth across all of our brands, with Aerie rising 85% and American Eagle up 17% for Fiscal 2020 compared to Fiscal 2019. Our digital channel generated strong profit margins and posted positive sales metrics, including traffic and transaction value.

| | | | | 50 | | |

| |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

• | | Continued Aerie Momentum. During Fiscal 2020, Aerie’s revenue rose 24% year-over-year, to $1 billion. Demand for the brand has been very consistent over the past several years, with the fourth quarter of Fiscal 2020 marking the 25th consecutive quarter of double-digit growth. New customer growth was strong, and sales rose across channels and all major categories.

|

• | | Sequential Margins and Profitability Strength. During Fiscal 2020, margins and profitability strengthened sequentially, with fourth quarter 2020 adjusted operating profit(1) of $106 million up 38% from the fourth quarter of Fiscal 2019, and the second half of Fiscal 2020 posting adjusted operating profit(1) of $209 million. After the abrupt closure of our stores in March 2020, our team took quick, decisive action to reduce inventory, cut spending and find efficiencies. The stores team redesigned the store experience to reopen locations when it was safe to do so and with leading safety protocols in place. Through feedback from our customers and associates, as well as national recognition in various publications, we are confident that these efforts were appreciated. Although store traffic remained under pressure in 2020 due to continued concerns about COVID-19 as well as ongoing capacity restrictions, demand strengthened throughout the year, driving sequential quarterly sales and profit improvement.

|

(1) | See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures.

|

| | | | | | | | | | | | | | | | | 2023 Proxy Statement | | | | | 51 |

| | | | COMPENSATION DISCUSSION AND ANALYSIS | | | 2021 Proxy Statement

|

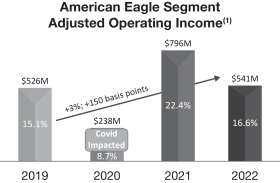

Multi-Year Structural Profit Improvement at American Eagle. During Fiscal 2022, AE revenue and profitability declined year-over-year as the business lapped extraordinary strength in Fiscal 2021, which saw a record Back-to-School season driven by pent-up demand as schools returned to in-person after two-years of virtual learning. Compared to pre-pandemic Fiscal 2019 levels, revenue declined 6%, yet segment adjusted operating income (1) grew 3% with the segment adjusted operating margin(1) expanding 150 basis points to 16.6%. This improvement was driven by the Company’s multi-year focus on eliminating unproductive SKUs and closing lower margin stores to improve the health of the brand. | | |

Fortified balance sheet and strong cash returns to stockholders. During Fiscal 2022, AEO retired $403 million in outstanding principal related to the Company’s convertible notes, representing 98% of the total issuance position. In connection with this, the Company also completed $200 million in share repurchases. Together, this strengthened the Company’s balance sheet and offset over half of the dilution related to the Company’s convertible note issuance position. In Fiscal 2022, the Company also paid $65 million in dividends to its stockholders. When combined with share repurchases, this reflected the highest cash returns to stockholders since Fiscal 2015. The Company temporarily paused its dividend in the third quarter of Fiscal 2022 to provide near-term flexibility as it navigated a tough macro environment. As profitability and cash flow recovered over the course of the second half of the year, the dividend was reinstated subsequent to the fourth quarter of Fiscal 2022. Fiscal 2021 Say on Pay Historically, we have received strong support on our Say on Pay proposals, which we have taken as an endorsement of our executive compensation programs. At the 2021 Annual Meeting of Stockholders, although our Say-on-Pay proposal received majority support, the vote outcome of 56% fell far short of our expectations. We used this opportunity to participate in significant stockholder outreach to learn more about the expectations and areas of concern for our stockholders. We used that invaluable insight to inform our approach and decisions in Fiscal 2021, making responsive changes to our program design and practices. We are proud that our Fiscal 2021 stockholder support for Say on Pay at the 2022 Annual Meeting of Shareholders was approximately 92%, which aligns with historical levels. This level of support reinforced that our Fiscal 2021 compensation program changes and stockholder engagement were positively received by stockholders. We maintained our Fiscal 2021 executive compensation program design in Fiscal 2022. | Say on Pay Proposal | | Stockholders’ Support Level |

| COMPENSATION DISCUSSION AND ANALYSISFiscal 2021 Executive Compensation | | 92% | Fiscal 2020 Executive Compensation | | 56% | Fiscal 2019 Executive Compensation | | 98% | Fiscal 2018 Executive Compensation | | 98% |

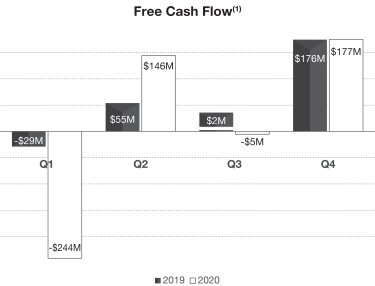

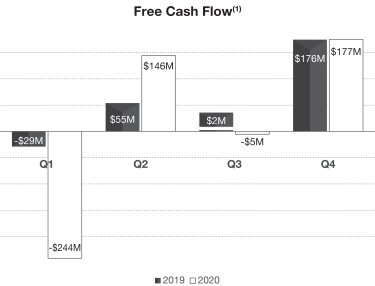

| (1) | Strong Balance SheetSee Appendix A of this Proxy Statement for additional detail on adjusted results and Commitment to Cash Returns. We ended Fiscal 2020 with $850 million in cash and approximately $1.2 billion in total liquidity. Excluding net proceeds from our April 2020 convertible note issuance, we ended Fiscal 2020 with $444 million in cash, up 7% from Fiscal 2019. Early inother important information regarding the year, we took actions to preserve our financial strength, which allowed us to generate free cash flow in the second halfuse of Fiscal 2020 in line with last year despite the reduction in revenue related to COVID-19. The recovery in cash flow enabled us to pay our previously deferred first quarter 2020 cash dividend in December 2020, and on March 3, 2021 we announced the reinstatement of our regularly quarterly cash dividend and unsuspended our share repurchase program.

Outstanding Stock Price Performance. As of April 2021, AEO’s stock price performance was up over 300% from a year ago, fueled by a significant and consistent recovery in our business after the abrupt COVID-19 related store closures in the first quarter of 2020. Through the team’s swift actions and strong management, we saw sequential improvement in our sales, margins and profit in each quarter of 2020. Aerie grew revenue 24% for the year, digital increased 36% and we ended 2020 with strong liquidity and cash flow. In January 2021, we also unveiled our Real Power. Real Growth value creation plan and long-term financial targets, providing investors with greater transparency into our future growth plans.

AEO Stock Price Performance

1) | See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures.

|

| | | | | | | | | | | | 52 | | | | |  | | | | | | |

| | | | | COMPENSATION DISCUSSION AND ANALYSIS |

| | | | | 52 | | |

Fiscal 2022 Overview, Compensation Program Objectives and Philosophy Fiscal 2022 was a year that presented a variety of challenges in a difficult macro environment. Consumers were pressured from rising inflation while continued supply chain disruptions drove elevated costs. After a challenging first half of the year, we were able to quickly pivot with decisions that led to a second half rebound. The collaboration, capability, and experience of our talented leadership team drove the initiatives that helped us produce revenue of $5 billion, improved free cash flow, and significant growth in second half operating profit. The overall philosophy of our executive compensation program is to attract and retain highly skilled, performance-oriented executives who live our brand and embody its spirit of authenticity and innovation. Our goal is to incentivize our executives to achieve outstanding results for all stakeholders within the framework of a principles-based compensation program. We focus on the following core principles in structuring an effective compensation program that meets this stated philosophy: | |

|

| | | COMPENSATION DISCUSSION AND ANALYSIS |

Our Look ForwardPerformance

| | • We align executive compensation with the achievement of qualitative and quantitative goals that we expect to drive increases in stockholder value. Unveiled Real Power. Real Growth Strategy Plan. The unforeseen events of 2020 accelerated the pace of global change

and innovation. In response to the challenges posed by the COVID-19 pandemic and the continued success of Aerie and

acceleration in our digital channel, we refocused our priorities and in January, 2021 unveiled our “Real Power. Real Growth”

strategy plan aimed at fueling AEO for further growth and profitability. The Real Power. Real Growth long-term plan leverages the

power of our people, brands and operations and the momentum we have generated in 2021. The pillars of Real Power. Real

Growth. include the following goals:

Double Aerie to $2 billion in revenue;

Reignite American Eagle for profit growth;

Leverage customer-focused capabilities;

Strengthen ROI discipline; and

Embrace the power of our people, culture and purpose.

Fiscal 2020 Compensation Takeaways

The results achieved in Fiscal 2020 were• Our program focuses on “at-risk” compensation, with remuneration that creates a direct result of the decisive actions taken by our CEO, executives, and Board,meaningful retention aspect as well as the resilience of our most important asset – our people. The innovation, collaboration, speed, and agility demonstrated by our teams delivered industry-leadingan incentive to achieve challenging performance including record online revenue growth, double-digit growth in Aerie, andobjectives.

• NEOs receive a strong focus on inventory optimization and execution in AE that led to margin growth and a strong year-end cash position. We believe that the decisions made by the Compensation Committee in the face of the COVID-19 challenges motivated our leaders to produce results, and that our compensation practices and our pay-for-performance philosophysubstantial long-term incentive component, which aligns thetheir interests of our executives with those of our stockholders. Specifically:stockholders and serves to retain executive talent through a multi-year vesting schedule.

• Our long-term incentive design varies actual compensation above or below the targeted compensation opportunity based on the degree to which performance goals and changes in stockholder value are attained over time. | Competitiveness | | • Executive compensation is structured to be competitive relative to a group of retail peers, taking into account company size relative to peers and recognizing our highly competitive industry as well as our emphasis on performance-based compensation. • Target total compensation for individual NEOs varies based on a variety of factors, including the executive’s skill set and experience, historic performance, expected future contributions, and the importance of each position to our success. | Affordability | | • Our compensation program is designed to limit fixed compensation expense and tie realized compensation costs to the degree to which budgeted financial objectives are attained. • We structure our incentive plans to maximize efficiency by striving to make performance-based payments aligned with expense. | Transparency | | • We focus on simple, straightforward compensation programs that our associates and stockholders can easily understand. |

Executive Compensation Program Highlights Our compensation program design provides a framework for aligning executive compensation and our long-term Company objectives and financial performance. We continually review leading practices in corporate governance and executive compensation. As appropriate, we consider changes to our program to embrace best practices, remain competitive in our industry, and reinforce the pay-for-performance alignment. | | | | | | | | | | | | | | | | | 2023 Proxy Statement | | | | | 53 |

| | | | COMPENSATION DISCUSSION AND ANALYSIS | | No routine changes to base salaries: The Compensation Committee did not increase base salaries of our NEOs for Fiscal 2020, other than two promotional base salary increases. For our CEO, this represents the fifth year of no change to his base compensation. As a result, a significant amount of NEO compensation for Fiscal 2020 was “at risk,” which we believe appropriately incentivizes our NEOs with respect to Company performance. During Fiscal 2020, only approximately 20% of our NEO compensation, on average, was guaranteed.

|

• | | Agility in our annual incentive bonus program and recognition of our leadership: To remain responsive to the unprecedented business challenges posed by the COVID-19 pandemic, our Compensation Committee developed an annual incentive bonus structure for Fiscal 2020 that recognized the need to motivate and focus our teams and measure performance in a different way than we have historically. This structure focused on measuring results based upon both our qualitative strategic business pillars – protecting our people, preserving cash, and preparing for a new future – as well as quantitative financial results. The focus on our qualitative strategic goals resulted in exceptional quantitative financial achievements, ultimately generating a payout of 200% of the target annual incentive bonus for all eligible associates and executives, including NEO’s, for Fiscal 2020. The Compensation Committee also awarded recognition bonuses to reflect the significant competitive landscape, strong leadership, and exceptional execution on our initiatives by our executives, including the NEOs, during Fiscal 2020.

|

• | | No adjustments or modifications to previously-granted long-term equity incentive awards: As previously disclosed in our 2019 proxy statement, performance shares (“PSUs”) previously granted in Fiscal 2018 vested based on cumulative performance results at the end of a three-year performance period that ended in Fiscal 2020. Despite the business impact of COVID-19 on Company performance during Fiscal 2020, the Compensation Committee did not exercise discretion to adjust the performance criteria applicable to the Fiscal 2018 PSUs. Based on these unadjusted results during the performance period, the Compensation Committee determined that the Fiscal 2018 PSUs would payout at a 50% level of achievement.

|

• | | Fiscal 2020 long-term equity incentive awards: In addition to a unique annual incentive bonus structure for Fiscal 2020, the Compensation Committee slightly modified our long-term incentive awards for Fiscal 2020, while remaining true to the historic performance-oriented nature of

The following table highlights the Company’s practices relating to our executive compensation program. Historically, the Compensation Committee has granted long-term equity awards in the form of 50% PSUs, 25% restricted stock units (“RSUs”) and 25% stock options. The Fiscal 2020 long-term equity program maintained the same equity components and the strong performance orientation, while altering the mix slightly. Accordingly, our Fiscal 2020 long-term incentive program delivered an aggregate mix composed of 42% RSUs, 33% PSUs, and 25% stock options. Effective for Fiscal 2021, the Compensation Committee has changed the long-term incentive equity mix to be 50% PSUs, 30% stock options, and 20% RSUs to provide for an even stronger performance orientation. |

| | | | | 2021 Proxy Statement

| | |

| | 53 |

| COMPENSATION DISCUSSION AND ANALYSIS |

Fiscal 2020American Eagle Outfitters’ Executive Compensation Program Objectives and Philosophy

The overall philosophy of our executive compensation program is to attract and retain highly skilled, performance-oriented executives who live our brand and embody its spirit of authenticity and innovation. Our goal is to incentivize our executives to achieve outstanding results for all stakeholders within the framework of a principles-based compensation program.

We focus on the following core principles in structuring an effective compensation program that meets this stated philosophy:

| | | Performance

| | • We align executive compensation with the achievement of qualitative and quantitative goals that we expect to drive increases in stockholder value.

• Our program focuses on “at-risk” compensation, with remuneration that creates a meaningful retention aspect, as well as an incentive to achieve challenging performance objectives.

• NEOs receive a substantial long-term incentive component, which aligns their interests with those of our stockholders and serves to retain executive talent through a multi-year vesting schedule.

• Our long-term incentive design varies actual compensation above or below the targeted compensation opportunity based on the degree to which performance goals and changes in stockholder value are attained over time.

| Competitiveness

| | • Executive compensation is structured to be competitive relative to a group of retail peers, taking into consideration company size relative to peers and recognizing our highly-competitive industry as well as our emphasis on performance-based compensation.

• Target total compensation for individual NEOs varies based on a variety of factors, including the executive’s skill set and experience, historic performance, expected future contributions, and the importance of each position to our success.

| Affordability

| | • Our compensation program is designed to limit fixed compensation expense and tie realized compensation costs to the degree to which budgeted financial objectives are attained.

• We structure our incentive plans to maximize financial efficiency by establishing programs that are intended to be tax deductible (whenever it is reasonably possible to do so while meeting our compensation objectives) and accounting efficient by striving to make performance-based payments aligned with expense.

| Transparency

| | • We focus on simple, straightforward compensation programs that our associates and stockholders can easily understand.Checklist

|

| | | | | | 54 | | |

| |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

Executive✓ A Compensation Highlights

Our compensation program design provides a framework for aligningCommittee composed entirely of independent directors oversees the Company’s executive compensation policies and our long-term Company objectives and financial performance. We continually review leading practices in corporate governance and executive compensation. As appropriate we consider changes to our program to embrace best practices, remain competitive in our industry, and reinforce the pay-for-performance alignment.decisions

The following table highlights the Company’s practices relating to our executive compensation program.

| | | American Eagle Outfitters’ Executive Compensation Checklist

| | ✓ A Compensation Committee composed entirely of independent directors oversees the Company’s executive compensation policies and decisions

| | ✓✓ The Compensation Committee utilizes an independent compensation consulting firm, FW Cook, which does not provide any other services to the Company

| | ✓ We maintain robust executive stock ownership guidelines (six times base salary for our CEO, and three times base salary for our other NEOs)

| | ✓ We pay for performance. The majority of our NEOs’ total compensation opportunities are “at-risk”

| | ✓ Our long-term incentive plan does not allow for the payment of dividends or dividend equivalents on unearned PSU awards or unvested RSU awards

| | ✓ We do not maintain (i) employment contracts of defined length with our NEOs, or (ii) multi-year guarantees for base salary increases, bonuses, or long-term incentives

| | ✓ We have a robust clawback policy with respect to both cash and equity incentive awards

| | ✓ We maintain a stringent anti-hedging and anti-pledging policy, applicable to all employees and non-employee directors

| | ✓ We do not provide significant perquisites

| | ✓ We do not provide tax gross-ups on change-in-control benefits

| | ✓ We have double-trigger cash severance and long-term incentive vesting in the event of a change-in-control

| | ✓ We discourage excessive risk-taking by having our Compensation Committee closely monitor the risks associated with our executive compensation program and individual executive compensation decisions to determine that they do not encourage excessive risk-taking

|

OUR EXECUTIVE COMPENSATION PROGRAM

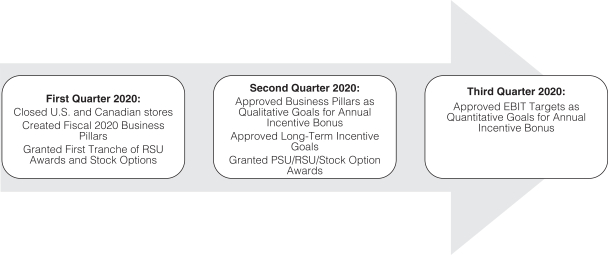

Fiscal 2020 Goal Setting Process

Goal Setting:

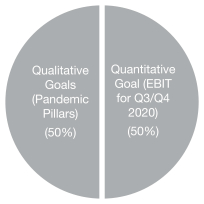

We remain committed to setting incentive goals that are aligned with delivering strong financial performance and returns to our stockholders, while also enabling the successful execution of our strategy. This includes building a solid foundation for long-term growth while consistently delivering near-term results. Against the backdrop of the significant and unanticipated impacts of the COVID-19 pandemic on our business and industry and ongoing uncertainty, the Compensation Committee introduced qualitative goals to the 2020 annual incentive bonus program and based the quantitative financial performance component of the annual incentive bonus program on performance during the third and fourth quarters of Fiscal 2020.

| | | | | 2021 Proxy Statement

| | |

| | 55 |

| COMPENSATION DISCUSSION AND ANALYSIS |

Timing of Award Grants:

Traditionally, the Compensation Committee sets performance goals for our annual incentive program and equity-based grants at the end of the first fiscal quarter of the year. During Fiscal 2020, this timing aligned with the initial impacts of the COVID-19 pandemic on our industry and business, which were both immediate and severe. Accordingly, the timing of setting our annual bonus goals and long-term incentives was delayed until the Compensation Committee felt that appropriate realistic qualitative and quantitative goals could be set.

• | | First quarter of Fiscal 2020.

|

| o | Qualitative Goals for Fiscal 2020 Annual Incentive Bonus: At the onset of the COVID-19 pandemic, the leadership team quickly established a key set of strategic business priorities: protect our people and business; preserve cash; and prepare for a new future. These near term priorities informed our focus for Fiscal 2020 and subsequently were accordingly approved as the qualitative goals for the annual incentive bonus in the second quarter of Fiscal 2020.

|

| o | Annual Approval of Long Term Incentive Grants (RSUs and Options): Typically our long term incentives are awarded in the first quarter of Fiscal 2020. Accordingly, in March 2020, the Compensation Committee chose to grant time-based RSUs to all eligible associates including the NEOs, as well as a partial grant of the annual stock options historically given to NEOs as part of their total compensation. The Compensation Committee was mindful of the remaining share balance available under the 2017 Stock Award and Incentive Plan, as amended (the “2017 Plan”). At the 2020 Annual Meeting, stockholders were asked to approve the adoption of the American Eagle Outfitters, Inc. 2020 Stock Award and Incentive Plan (the “2020 Plan”) to serve as the successor to the 2017 Plan. On June 4, 2020, stockholders overwhelmingly approved the 2020 Plan, which made an additional 10.2 million shares of Company stock available for grant as equity awards to our associates and executives.

|

| o | Quantitative Goals for Fiscal 2020: Given the significant impact of store closures during the first and second quarters of Fiscal 2020 and the related disruption to our business, the Compensation Committee believed that the most prudent course of action was to wait until the third quarter of Fiscal 2020 to establish the quantitative financial performance goal for the 2020 annual incentive program. The Compensation Committee did not believe that it was in a position to adequately assess business projections or establish well-informed and challenging financial goals with respect to Fiscal 2020 until such date. During the third quarter of Fiscal 2020, the Compensation Committee set the EBIT goals for the annual incentive bonus based on what it believed would be challenging, yet attainable goals for the balance of the year, and in particular, focusing on the executives on recouping as much of the financial loss suffered by the Company in the first half of Fiscal 2020 as possible. Achievement of the EBIT levels set by the Compensation Committee required significant sales and margin improvement from forecasts at the time the goals were set, as well as expense reduction.

|

| o | Annual Approval of Long Term Incentive Grants (PSUs, RSUs and Options). Given continued uncertainties in the retail industry, the Compensation Committee granted Fiscal 2020 PSU awards using relative TSR as the performance metric in lieu of historic financial goals. The Committee also awarded additional stock option awards in June 2020 as well as an RSU award to the executives.

|

| | | | | 56 | | |

| |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

Role of Our Compensation Committee:

The Board has delegated authority to the Compensation Committee to develop and approve the overall compensation program for our NEOs, including the authority to establish and award annual base salaries, annual incentive bonuses, and long-term incentive awards pursuant to our stockholder-approved incentive plan. Furthermore, the Compensation Committee reviews and approves changes to our compensation peer group, as appropriate. In making its decisions, the Compensation Committee takes into consideration a variety of factors, including suggestions made by the CEO, compensation consultants, and the Company’s external advisory firms. The Compensation Committee acts in accordance with its charter, which can be found on our Investors website at investors.ae.com.

Role of Executive Officers in Compensation Decisions:

Our CEO annually reviews the performance of each NEO and makes recommendations to the Compensation Committee with respect to each element of executive compensation for the NEOs, excluding himself. The CEO considers Company, brand, and individual performance and market positioning in his recommendations to the Compensation Committee with regard to total compensation for all NEOs. The Compensation Committee makes the final determination of individual compensation levels and awards, taking into consideration the CEO’s recommendations. CEO compensation is determined with input from the compensation consultant, FW Cook, informed by market benchmarking, and ultimately approved by the Compensation Committee.

Role of Compensation Consultants:

The Compensation Committee has the authority under its charter to retain outside consultants or advisors for assistance. In accordance with this authority, during Fiscal 2020, the Compensation Committee continued to retain the services of FW Cook as its outside independent compensation consultant to advise on matters related to CEO and other executive compensation. The services provided by FW Cook are subject to a written agreement with the Compensation Committee. The Compensation Committee has sole authority to terminate the relationship. The Compensation Committee reviewed its relationship with FW Cook and determined that there are no conflicts of interest pursuant to applicable SEC and NYSE requirements. FW Cook does not provide any other services to the Company. The Compensation Committee may engage other consultants as needed in order to provide analyses, recommendations, or other market data. Under the direction of the Compensation Committee, FW Cook interacts with members of the senior management team to provide insights into market practices and ensure that management is aware of emerging best practices and market trends. In Fiscal 2020, representatives from FW Cook contributed to this CD&A, evaluated the Company’s peer group and assisted with various matters related toCompany

| | ✓ We maintain robust executive compensation. During Fiscal 2020, management also engaged Korn Ferry to advise on market practices and provide market benchmarking relative to executive compensation. Response to 2020 Advisory Vote on Executive Compensation:

At our 2020 Annual Meeting of Stockholders, approximately 98% of shares present and voting supported, on an advisory basis, the compensation of our NEOs in Fiscal 2019. While this vote demonstrated a very high level of supportstock ownership guidelines (six times base salary for our compensation program, our executive team remained engaged with stockholders throughout Fiscal 2020. We welcome feedback and value regular dialogue with our stockholders. On a regular basis, we invite stockholders to meet with senior management. In Fiscal 2020, the Company continued to have extensive engagement with our stockholders. Throughout the year, our CEO, and senior management held numerous meetings with investors and participated in several virtual investor conferences, during which we met with current and prospective stockholders. These meetings were generally focused on Company performance, specific measures to successfully manage through the COVID-19 pandemic as well as long-term strategic initiatives aimed at driving growth and stockholder returns. Additionally, management hosted a virtual investor meeting in January 2021 during which we presentedthree times base salary for our Real Power. Real Growth value creation plan and unveiled our long-term financial outlook. The content of these meetings and discussions were reported to the Board, and management and the Board discussed comments and business insights provided by these stockholders. We expect to continue such discussions prior to the 2021 Annual Meeting and, as a matter of policy and practice, foster and encourage engagement with our stockholders on an ongoing basis. As a result of this engagement and the high level of support evidenced by our stockholders’ vote at the 2020 Annual Meeting of Stockholders, the Compensation Committee determined that our compensation incentive programs are achieving their respective goals and did not take any specific action in response to the 2020 say on pay vote or such engagement.

| | | | | 2021 Proxy Statement

| | |

| | 57 other NEOs) |

| COMPENSATION DISCUSSION AND ANALYSIS | |

Compensation Benchmarking

The nature of the retail industry is highly competitive✓ We pay for talent.performance. The challenges presented in Fiscal 2020 further intensified the competitive landscape. Talented leaders with proven capability and experience delivering results, like those on our team, became in higher demand than ever before. In 2020, the core group of competitors for talent was expanded beyond those in the specialty retail space to include retailers in the “essential” category who could benefit from the proven experience of the members of our leadership team. The retention of this talent is a primary element of our success and delivery of results to stockholders.

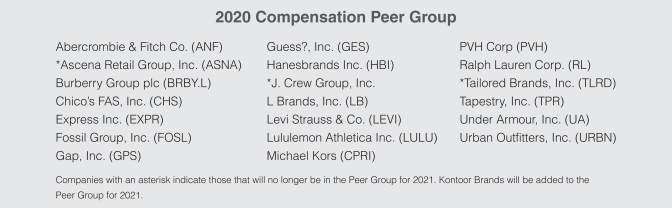

In determining NEO compensation, the Compensation Committee reviews and takes into account the compensation practices of comparable companies. The Compensation Committee considers three key factors in choosing the companies that compose our peer group:

Talent – Companies with which we compete for executive-level talent;

Size – Companies with comparable revenue; and

Comparability – Companies within the retail industry with which we compete for customers and investors.

Other selection criteria include e-commerce omni-channel retailing and a review of those companies listed as our peers by proxy advisory firms. We evaluate our peer group on an annual basis and propose changes when appropriate. For Fiscal 2020, our peer group consisted of 20 companies. We approximate the median of the peer group based on revenue, with our market capitalization within the second quartile of the peer group’s range. Peer group data also is supplemented as needed with additional data from various retail and general industry market surveys, as adjusted to reflect our revenue scope.

In the fourth quarter of Fiscal 2020, the Compensation Committee approved changes to our peer group effective for Fiscal 2021, based upon an analysis completed by FW Cook. One company, Kontoor Brands, was added to the peer group and three companies were removed due to bankruptcy (Ascena Retail Group, J. Crew Group, Inc., and Tailored Brands). The Company’s relative size, position near the median in revenue and second quartile in terms of market capitalization is maintained in the 2021 peer group.

| | | | | 58 | | |

| |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

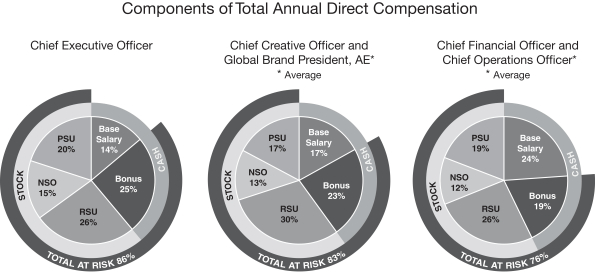

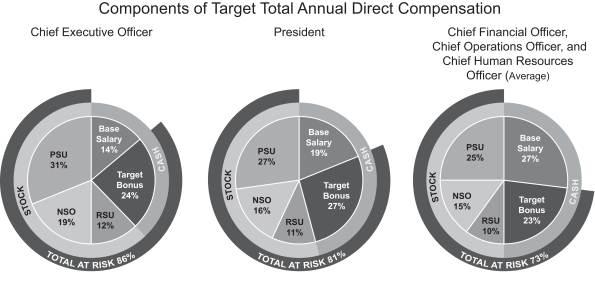

How We Pay Our Executives and Why: Elements of Annual Compensation

Our executive annual compensation program includes fixed components (base salary, benefits, and limited executive perquisites) and variable components (annual bonus and long-term incentive awards), with the heaviest weight generally placed on the variable, or “at-risk,” components. For Fiscal 2020, a significant majority of our NEOs’ target annual directtotal compensation which includesopportunities are “at-risk”

| | ✓ Our long-term incentive plan does not allow for the payment of dividends or dividend equivalents on unearned PSU awards or unvested RSU awards | | ✓ We do not maintain (i) employment contracts of defined length with our NEOs, or (ii) multi-year guarantees for base salary target annual bonus,increases, bonuses, or long-term incentives | | ✓ We have robust clawback provisions with respect to both cash and equity incentive awards | | ✓ We maintain a stringent anti-hedging and anti-pledging policy, applicable to all employees and non-employee directors | | ✓ We do not provide tax gross-ups on change-in-control benefits | | ✓ We have double-trigger cash severance and long-term incentives, was weighted toward at-riskincentive vesting in the event of a change in control | | ✓ We discourage excessive risk-taking by having our Compensation Committee closely monitor the risks associated with our executive compensation as shown by the charts below.program and individual executive compensation decisions to determine that they do not encourage excessive risk-taking | | |

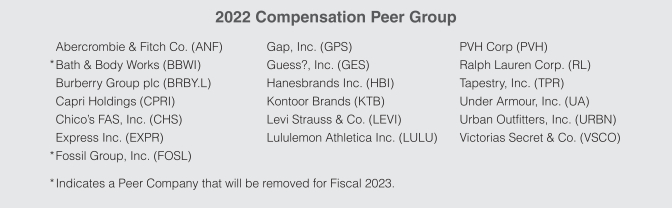

OUR EXECUTIVE COMPENSATION PROGRAM Fiscal 2022 Goal Setting Process Goal Setting: We remain committed to setting incentive goals that are aligned to delivering strong financial performance and returns to our stockholders, while also enabling the successful execution of our strategy. In the first quarter of Fiscal 2022, our Compensation Committee set the goal for the Annual Incentive Plan (“AIP”), measured on Earnings before Interest and Taxes (“EBIT”), informed by our strong financial performance in 2021 and initial optimism about the macro environment. EBIT is a non-GAAP measure, and when used in this CD&A, is defined as earnings before interest and taxes and excludes any asset impairment and restructuring charges, as determined by the Compensation Committee. Role of Our Compensation Committee: The Board has delegated authority to the Compensation Committee to develop and approve the overall compensation program for our NEOs, including the authority to establish and award annual base salaries, annual incentive bonuses, and long-term incentive awards pursuant to our stockholder-approved incentive plan. Furthermore, the Compensation Committee reviews and approves changes to our compensation peer group, as appropriate. In making its decisions, the Compensation Committee takes into consideration a variety of factors, including suggestions made by the CEO, compensation consultants, and the Company’s external advisory firms. The Compensation Committee acts in accordance with its charter, which can be found on our Investors website at investors.ae.com. | | | | | | | | | | | | 54

| | | | |  | | | | | | |

| | | | | COMPENSATION DISCUSSION AND ANALYSIS |

Role of Executive Officers in Compensation Decisions: Our CEO annually reviews the performance of each NEO and makes recommendations to the Compensation Committee with respect to each element of executive compensation for the NEOs, excluding himself. The CEO considers Company, brand, and individual performance and market positioning in his recommendations to the Compensation Committee with regard to total compensation for all NEOs. The Compensation Committee makes the final determination of individual compensation levels and awards, taking into consideration the CEO’s recommendations. CEO compensation is determined with input from the compensation consultant, FW Cook, informed by market benchmarking, and ultimately approved by the Compensation Committee. Role of Compensation Consultants: The Compensation Committee has the authority under its charter to retain outside consultants or advisors for assistance. In accordance with this authority, during Fiscal 2022 the Compensation Committee continued to retain the services of FW Cook as its outside independent compensation consultant to advise on matters related to CEO and other executive compensation. The services provided by FW Cook are subject to a written agreement with the Compensation Committee. The Compensation Committee has sole authority to terminate the relationship. The Compensation Committee reviewed its relationship with FW Cook and determined that there are no conflicts of interest pursuant to applicable SEC and NYSE requirements. FW Cook does not provide any other services to the Company. The Compensation Committee may engage other consultants as needed in order to provide analyses, recommendations, or other market data. Under the direction of the Compensation Committee, FW Cook interacts with members of the senior management team to provide insights into market practices and ensure that management is aware of emerging best practices and market trends. In Fiscal 2022, representatives from FW Cook contributed to this CD&A and assisted with various matters related to executive compensation. Response to 2022 Advisory Vote on Executive Compensation and Stockholder Engagement: At our 2022 Annual Meeting of Stockholders, approximately 92% of shares present and voting supported, on an advisory basis, the compensation of our NEOs in Fiscal 2021. This vote was consistent our historically high levels of stockholder support for Say on Pay and reinforced the support for our compensation program design changes in 2021 and pay and performance alignment. We invite stockholders to meet with senior management on a regular basis. In Fiscal 2022, the Company continued to have extensive engagement with our stockholders and met with approximately 30% of our top 100 stockholders, who collectively owned approximately 50% of the total shares outstanding as of January 28, 2023. Throughout the year our CEO and senior management held numerous meetings and calls with investors and participated in several investor conferences, during which they met with current and prospective stockholders. These meetings were generally focused on Company performance as well as long-term strategic initiatives aimed at driving growth and stockholder returns. We expect to continue such discussions prior to the 2023 Annual Meeting and, as a matter of policy and practice, foster and encourage engagement with our stockholders on an ongoing basis. Compensation Benchmarking In determining NEO compensation, the Compensation Committee reviews and takes into account the compensation practices of comparable companies. The Compensation Committee considers three key factors in choosing the companies that compose our peer group: Talent – Companies with which we compete for executive-level talent; Size – Companies with comparable revenue; and Comparability – Companies within the retail industry with which we compete for customers and investors. Other selection criteria include e-commerce omni-channel retailing and a review of those companies listed as our peers by proxy advisory firms. We evaluate our peer group on an annual basis and propose changes when appropriate. For Fiscal 2022, our peer group consisted of 19 companies. We approximate the median of the peer group based on revenue and market capitalization Peer group data also is supplemented as needed with additional data from various retail and general industry market surveys, as adjusted to reflect our revenue scope. For Fiscal 2023, the Peer Group has been updated to remove Fossil and Bath & Body Works, which will result in 17 companies. | | | | | | | | | | | | | | | | | 2023 Proxy Statement | | | | | 55 |

| | | | COMPENSATION DISCUSSION AND ANALYSIS | | | 2021 Proxy Statement

|

How We Pay Our Executives and Why: Elements of Annual Compensation Our executive annual compensation program includes fixed components (base salary, benefits, and limited executive perquisites) and variable components (annual incentive bonus and long-term incentive awards), with the heaviest weight generally placed on the variable, or “at risk,” components. For Fiscal 2022, a significant majority of our NEOs’ target annual direct compensation, which includes base salary, target annual incentive bonus, and a long-term incentive award, was weighted toward at-risk compensation, as shown by the charts below.

Standard Elements of Compensation: The compensation for our NEOs is –

| COMPENSATION DISCUSSION AND ANALYSIS |

Standard Elements of Compensation:

The compensation for our NEOs is (i) balanced to provide a mix of cash and long-term incentive awardsawards; and (ii)

|

| • | | focused on both annual and long-term performance to ensure that executives are held accountable and rewarded for achievement of both annual and long-term financial and strategic objectives. | | | | | | | | | | | Element of

Compensation | | Form and Objective | | Fiscal 2020 Information | | Alignment to Strategic Plan | | | | | | | | Base Salary

| | • Delivered in cash.

• Provides a baseline compensation level that delivers cash income to each NEO, and reflects his or her job responsibilities, experience, skill set, and contribution to the Company.

| | • Our CEO did not receive a base salary increase for Fiscal 2020, for the fifth year in a row.

• The balance of the NEO’s did not receive a base salary increase in 2020, with the exception of promotional increases for Ms. Foyle and Mr. Mathias.

| | • Base salaries set at competitive market levels that enable us to attract and retain qualified, high-caliber executive officers to lead and implement our strategy.

| | | | | | | | Annual Incentive Bonus

| | • Delivered in cash.

• Provides an opportunity for additional income to NEOs if pre-established performance goals are attained, which focuses our NEOs on key annual objectives.

| | • For Fiscal 2020, the incentive bonus was based 50% upon the Company achieving quantitative second half EBIT goals at pre-determined threshold, target and stretch performance levels and 50% upon the achievement of qualitative business objectives at target and stretch performance levels.

• Performance was realized at stretch levels on both the quantitative and qualitative objectives, resulting in a payout at 200% of target.

| | • Annually, the Compensation Committee establishes performance metrics and goals that align with our strategic plan.

• The 2020 Annual Incentive Bonus structure, combining and equally weighting both quantitative and qualitative elements for Fiscal 2020 reflected the Compensation Committee’s responsiveness to the unique challenges, risks and uncertainties of the COVID-19 pandemic and its impact on the business.

| | | | | | | | Annual Long-Term

Incentive Awards

| | • Delivered in PSUs, RSUs, and stock options.

• Aligns our NEOs’ financial interests closely with those of our stockholders.

• Links compensation to the achievement of multi-year financial or relative TSR goals.

| | • PSUs represented 33% of the annual target grant values for Fiscal 2020 equity awards and vest between threshold and stretch level only to the extent that the pre-established, three-year performance goals are met. If performance falls below the threshold, the award is forfeited in full.

• RSUs represented 42% of the annual equity grant target value for Fiscal 2020 equity awards. 60% of RSUs were granted in March 2020. These RSUs vest ratably over three years from the grant date based on continued service. Approximately 40% of RSUs were granted in June 2020. These RSUs cliff vest in March 2023, based upon continued service. In each case, these RSUs serve as a retention tool for our NEOs.

• In 2020, stock options represent 25% of the annual equity grant target value, vest ratably over three years from the grant date and provide compensation only to the extent that our share price appreciates.

| | • Aligns NEO compensation with our longer-term performance objectives and changes in stockholder value over time.

• In 2020, the long-term incentive award mix was modified in response to the unique challenges to the business and our compensation structure presented by the COVID-19 pandemic. The Compensation Committee determined to modify the traditional PSU value of 50% and increase the relative number of RSUs granted. The Compensation Committee believes that this equity delivery mix served to maintain a strong performance focus while also delivering a long-term focus on retention to ensure leadership continuity.

• In 2021, the long-term incentive award mix will be an equity blend of 50% PSUs, 30% stock options, and 20% RSUs.

|

| | | | | 60 | | |

| |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

| | | | | | | | | | | | 56 Fiscal 2020 Compensation

| | | | | The following provides additional details regarding our compensation components and related decisions for Fiscal 2020. Our executive compensation program places a considerable amount of compensation at risk to cultivate a pay-for-performance environment.

Base Salary

Base salaries, on average, represent approximately 20% of each NEO’s target total direct compensation. The Compensation Committee reviews NEO’s base salaries annually after considering the following factors:

| | | | | | |

The scope

| | | | | COMPENSATION DISCUSSION AND ANALYSIS |

| | | | | | | | | | | Element of

Compensation | | Form and responsibility ofObjective | | Fiscal 2022 Information | | Alignment to Strategic Plan | | | | | | | | Base Salary | | • Delivered in cash. • Provides a baseline compensation level that delivers a predictable level income to each NEO and reflects his or her job responsibilities, experience, skill set, and contribution to the NEO’s position;Company. | | The achievement of strategic and operational business goals;

The climate in the retail industry, general economic conditions, and other factors;

Each NEO’s experience, knowledge, skills, and personal contributions;

The level of overall compensation paid by competitors for similar positions in the retail industry; and

The appropriate balancing of base salary against “at risk” compensation.

• Base salary increases where applicable, typically are effective in the first quarter of the new fiscal year. For Fiscal 2020, our CEO did not receive a base salary increase for the fifth year in a row. The balance ofapproximately 3% to 10% were delivered to the NEOs did not receive a base salary increase(other than Mr. Schottenstein) for Fiscal 2020, with2022 to recognize their significant contributions, expertise, and the exception of a promotional base salary increase for Ms. Foylevery competitive talent market in our industry. | | • Base salaries enable us to attract and Mr. Mathias. Please see “Fiscal 2020 Promotions,” below, for an additional description of Ms. Foyle’sretain qualified, high-caliber executive officers to lead and Mr. Mathias’s base salary increases during Fiscal 2020.implement our strategy. | | | | | | | | Fiscal 2020 Annual Incentive Bonus

| | • Delivered in cash. Our• Provides bonus opportunities for NEOs if pre-established performance goals are eligible for annual cash incentive awards, the achievement of which is based upon the Company meeting pre-established performance goals. The Compensation Committee believes that setting these goals focuses the executive teamattained, focusing our NEOs on key annual objectives.

Consistent with these objectives,

| | • For Fiscal 2022, the Compensation Committee consideredincentive bonus was based 100% upon the impactCompany achieving annual EBIT goals at pre-determined threshold, target and stretch performance levels. • Actual performance fell short of the COVID-19 pandemicthreshold payout levels and related uncertainties on the Company’s operations and the retail industry in general and determined that certain adjustments to the Fiscal 2020 Annual Incentive Bonus design were necessary in order to continue to provide an appropriate incentive for performance as well as to motivate and focus the team. These adjustments include:a bonus was not earned. | | Bifurcating the performance goals based on achievement of qualitative performance goals (50%) and a quantitative performance goal of EBIT (50%); and

Evaluating achievement of EBIT based solely on performance during the second half of Fiscal 2020.

| | | | | 2021 Proxy Statement

| | |

| | 61 |

| COMPENSATION DISCUSSION AND ANALYSIS |

Understanding the unique challenges and uncertainties faced during the year and the need to focus on innovative operational solutions and cash preservation as much as generating EBIT, the Compensation Committee chose to implement a blended annual incentive metric approach that included qualitative performance metrics.

During Fiscal 2020, management was focused on our “Pandemic Pillars,” which consisted of the three strategic business priorities described below and represented the goals for the qualitative portion of the Fiscal 2020 annual bonus program:

| | |

PROTECT OUR PEOPLE + BUSINESS

| | • Protect AEO’s long-term interests in the face of global disruptions.

• Implement best-in-class health and safety measures to care for our associates, customers and partners.

• Manage critical relationships with landlords and vendors.

• Prioritize inclusion and diversity efforts to ensure a strong and diverse organization.

|

PRESERVE CASH

| | • Ensure AEO has ample cash to manage through 2020 and beyond.

• Create a corporate culture that prioritizes cash returns on investments.

• Invest wisely and align merchandise expense with adjusted sales plans.

• Reduce short-term discretionary spend where possible and leverage learnings to make improvements in cost structure.

|

PREPARE FOR A NEW FUTURE

| | • Fuel Aerie, strengthen AE, and seek opportunities to accelerate growth.

• Lean into our digital channel, while optimizing the store business through technology and leading customer experience.

• Leverage lease flexibility to evaluate future store needs.

• Innovate supply chain capabilities to increase speed and flexibility, while ensuring adequate staffing levels and continued productivity.

|

As in prior years, EBIT was chosen as the quantitative financial measure for the annual bonus as it reflects both sales growth and expense management initiatives. The Compensation Committee also believes that the selection of EBIT as a performance measure directly links the Company’s long-term growth with stockholder value. For 2020, EBIT was measured during the third and fourth quarters of Fiscal 2020.

Setting Target Bonus Opportunities

Early in the year,• Annually, the Compensation Committee establishes each NEO’sperformance metrics and goals that align with our strategic plan.

• The 2022 annual incentive bonus opportunity asstructure represented a percentagefocus on quantitative financial goals at 100%. | | | | | | | | Annual Long-Term Incentive Awards | | • Delivered in PSUs, RSUs, and stock options. • Aligns our NEOs’ financial interests closely with those of our stockholders. • Links compensation to the achievement of multi-year financial or relative TSR goals. | | • PSUs represented 50% of the NEO’s base salary.annual target grant values for Fiscal 2022 equity awards and vest between threshold and stretch level only to the extent that the pre-established, three-year performance goals are met. If performance falls below the threshold, the award is forfeited in full. For 2020, there were no increases to target bonus opportunities for any2022, the PSUs are measured on RTSR. • In 2022, stock options represented 30% of the NEOs, withannual equity grant target value, vest ratably over three years from the exceptiongrant date based on continued service and provide compensation only to the extent that our share price appreciates. • RSUs represented 20% of athe annual equity grant target bonus increasevalue for Ms. Foyle and Mr. Mathias consistent with their significant promotions duringFiscal 2022 equity awards. These RSUs vest ratably over three years from the year. Ms. Foyle’s target bonus increased from 130% to 140% of base salary and Mr. Mathias’s target bonus increased from 40% to 65% of base salary. Target bonus award opportunities typically constitute over 18% of each NEO’s target total direct compensation for the year. During Fiscal 2020, the target bonus award opportunities for the NEOs were set as follows:grant date based on continued service.

| | | • Aligns NEO compensation with our longer-term performance objectives and changes in stockholder value over time. | Executive Officer

|

| | | | | | | | | | | | | | | | | 2023 Proxy Statement | | | | | 57 |

| | | | COMPENSATION DISCUSSION AND ANALYSIS | | Target (as a Percentage of Base Salary) | CEO

| | 175% | CFO

| | 65% | Chief Creative Officer

| | 140% | Global Brand President, AE

| | 130% | COO

| | 90% | Former CFO(1)

| | — |

(1) | The Former CFO was ineligible for a Fiscal 2020 Annual Incentive Award.

Fiscal 2022 Compensation The following provides additional details regarding our compensation components and related decisions for Fiscal 2022. Our executive compensation program places a considerable amount of compensation “at risk” to cultivate a pay-for-performance environment. Base Salary Base salaries, on average, represent approximately 24% of each NEO’s target total direct compensation. The Compensation Committee reviews NEOs’ base salaries annually after considering the following factors: The scope and responsibility of the NEO’s position; The achievement of strategic and operational business goals; The climate in the retail industry, general economic conditions, and other factors; Each NEO’s experience, knowledge, skills, and personal contributions; The level of overall compensation paid by competitors for similar positions in the retail industry; | • | | Necessary adjustments to right-size compensation elements to market levels; and |

The appropriate balancing of base salary against “at risk” compensation. Base salary increases, where applicable, typically are effective in the first quarter of the new fiscal year. For Fiscal 2022, our NEOs received the following increases to base salary, based on our competitive review of market information and merit, as outlined below. | | | | | | | | | Executive Officer | | Fiscal 2021

Base Salary | | | Fiscal 2022

Base Salary | | Context | | | | | | Mr. Schottenstein: CEO | | $ | 1,750,000 | | | $1,750,000:

no base

salary

increase | | • Mr. Schottenstein’s contributions to our financial success have been significant. His extensive experience has been instrumental in helping AEO manage through unprecedented times, especially in the dynamic retail landscape we have been experiencing since 2020. • Mr. Schottenstein’s leadership was key to shaping our swift actions taken at the start of Fiscal 2022 to set the business up for improved financial performance in the second half of the year. • Given Mr. Schottenstein’s competitive base salary position as compared to market, no changes were made to his salary for Fiscal 2022. | | | | | | Mr. Mathias: CFO | | $ | 725,000 | | | $800,000 | | • Mr. Mathias served a crucial role in leading the actions taken to drive a second half rebound in our Fiscal 2022 financial results. This includes strengthening inventory management, expense controls and an improvement in free cash flow generation. • Mr. Mathias’ base salary was increased to continue to align his compensation competitively to market levels. |

| | | | | | | | | | | | 58 | | | | |  | | | | | | |

| 62 | | |

| |

|

| | COMPENSATION DISCUSSION AND ANALYSIS | COMPENSATION DISCUSSION AND ANALYSIS |

| | | | | | | | | | | Executive Officer | | Fiscal 2021

Base Salary | | | Fiscal 2022

Base Salary | | | Context | | | | | | Ms. Foyle: President | | $ | 1,300,000 | | | $ | 1,400,000 | | | • Ms. Foyle also took on additional responsibilities in leading the American Eagle brand in late 2020. Under her leadership, the brand has driven improvements to merchandise, marketing and inventory management. Fiscal 2022 segment operating profit increased versus Fiscal 2019 reflecting the brand’s focus on profitable sales. • Ms. Foyle’s base salary increase is a result of her contributions to our powerful brand portfolio. Aerie continues to be on a strong multi-year growth trajectory, reaching a new milestone at $1.5 billion in revenue in Fiscal 2022. Since Fiscal 2019, revenue has nearly doubled with segment adjusted operating profit up close to 150%. | | | | | | Mr. Rempell: COO | | $ | 950,000 | | | $ | 1,050,000 | | | • Mr. Rempell strives to bolster innovation, seeking new tools and technologies to create efficiencies across AEO’s supply chain, enhance the customer experience and improve our operating model. • Mr. Rempell’s base salary increase recognizes his leadership in enhancing our digital channel and his expanded responsibility for the Todd Snyder brand. | | | | | | Ms. Baldwin: CHRO | | $ | 525,000 | | | $ | 570,000 | | | • Ms. Baldwin plays an important role in leading AEO’s strong corporate culture. In Fiscal 2022, the Company further enhanced its inclusion and diversity initiatives and continued to support important causes through the AEO foundation and corporate giving program. Ms. Baldwin is also responsible for our ESG strategy, including the publication of our inaugural ESG report in Fiscal 2022. | | | | | | Mr. McLean: Former CCO | | $ | 950,000 | | | $ | 985,000 | | | • Mr. McLean’s base salary increase recognized his strong leadership across AEO’s robust store fleet, his focus on innovation, and his International expertise provided valuable contributions in Fiscal 2022. |

Fiscal 2022 Annual Incentive Bonus Our NEOs are eligible for annual cash incentive awards, the achievement of which is based upon the Company meeting pre-established performance goals. For 2022, 100% of the AIP was based upon the achievement of annual EBIT goals. As in prior years, EBIT was chosen as the financial measure for the AIP as it reflects both sales growth and margin and expense management initiatives. EBIT represents operating income, as reported in our consolidated financial statements, before interest expense and income taxes. The Compensation Committee also believes that the selection of EBIT as a performance measure directly links the Company’s long-term growth with stockholder value. Setting of Fiscal 2020 Performance Goals

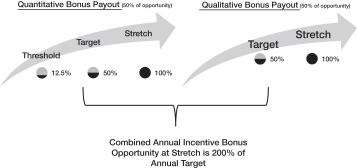

Based upon pre-established goals and achievement of the same, actual annual incentive bonus payments for Fiscal 2020 were calculable as follows, with straight-line interpolation between points for the quantitative EBIT goal: